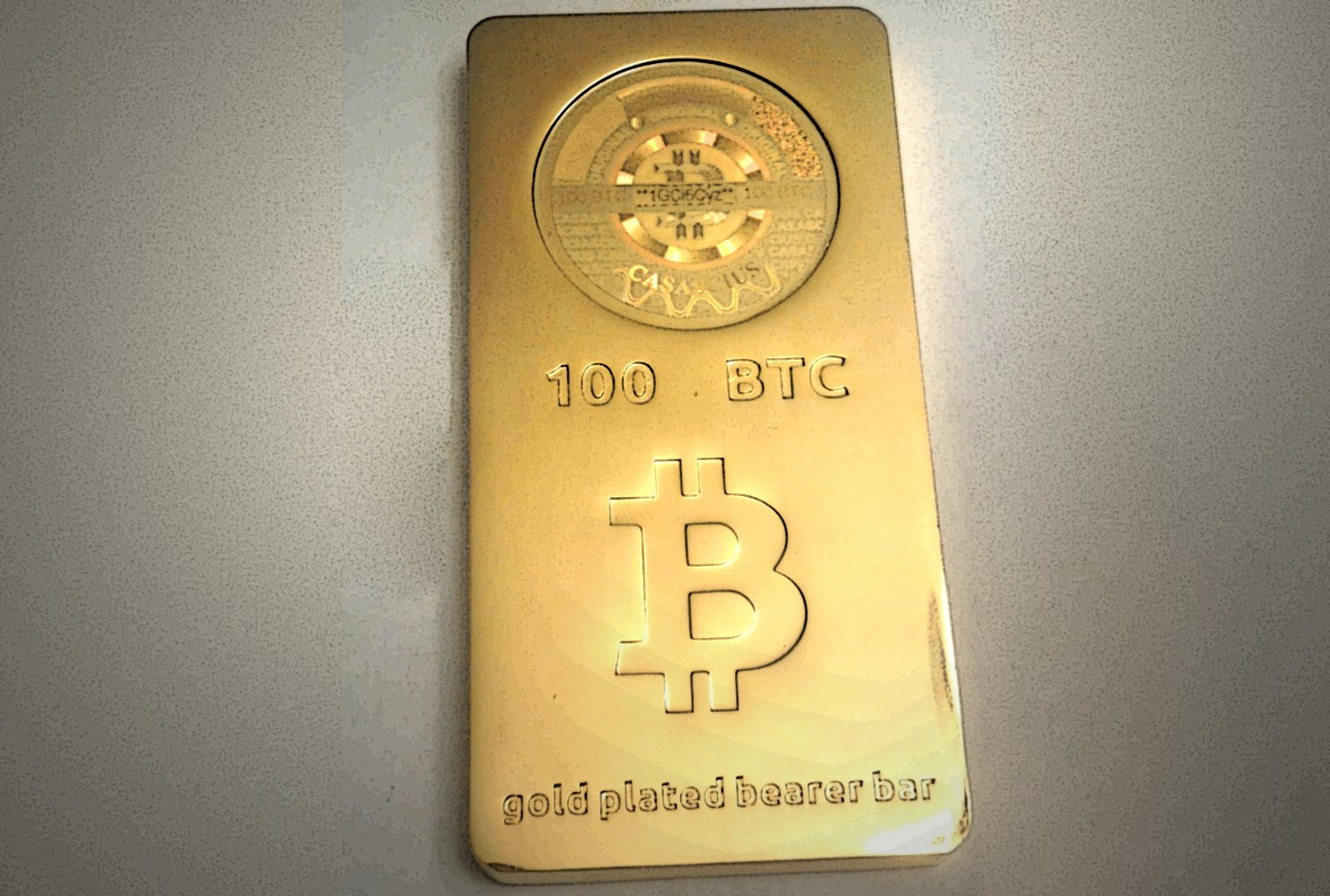

How Much are 100 Bitcoins Worth: Unveil the Fortune!

As of today, 100 Bitcoins are worth approximately $5.6 million. Bitcoin's value fluctuates based on market conditions.

Bitcoin, the world's first cryptocurrency, has gained immense popularity. Created by an unknown person or group using the name Satoshi Nakamoto, Bitcoin offers a decentralized digital currency system. Its value has seen dramatic highs and lows since its inception in 2009.

Many investors view Bitcoin as a digital asset and a potential hedge against traditional financial systems. Due to its limited supply of 21 million coins, demand often drives its price. Staying informed about Bitcoin's current value is crucial for investors and enthusiasts. Always check reliable financial sources for the most up-to-date information.

Credit: rawandev.medium.com

The Bitcoin Phenomenon

The world of finance has seen many changes. One of the most exciting is the rise of Bitcoin. Bitcoin is a digital currency that has captured the attention of many. People are curious about its value and potential. Understanding Bitcoin's worth can be fascinating and useful.

Rise Of Digital Currency

Digital currencies have changed how we think about money. Traditional currencies are controlled by governments. Bitcoin, on the other hand, is decentralized. This means no single entity controls it. Bitcoin was created in 2009 by an unknown person or group called Satoshi Nakamoto.

The main goal was to create a new kind of currency. Bitcoin allows for peer-to-peer transactions. This means people can send money directly to each other. Transactions are fast and secure. They are verified by network nodes through cryptography. This ensures that the system is safe and trustworthy.

Bitcoin's Place In The Financial World

Bitcoin has a unique place in the financial world. It is often referred to as "digital gold." This is because it shares some properties with gold. Both are scarce and have to be mined. Mining Bitcoin involves solving complex math problems. This process ensures that new Bitcoins are created at a controlled rate.

The value of Bitcoin can be very volatile. Its price can change rapidly. In December 2017, Bitcoin reached nearly $20,000. Then, in 2018, its value dropped significantly. Despite its volatility, many people believe in its long-term potential. Some view it as a hedge against inflation and currency devaluation.

Bitcoin has also gained acceptance among major companies. Some businesses now accept Bitcoin as payment. This includes large companies like Microsoft and Overstock. As more companies adopt Bitcoin, its value and utility may continue to grow.

To understand Bitcoin's worth, one must look at its current market price. The price of Bitcoin fluctuates. It depends on demand and supply. You can check the current price on various cryptocurrency exchange websites.

Here is a simple table to show the worth of 100 Bitcoins at different prices:

| Bitcoin Price (USD) | Worth of 100 Bitcoins (USD) |

|---|---|

| $10,000 | $1,000,000 |

| $20,000 | $2,000,000 |

| $30,000 | $3,000,000 |

| $40,000 | $4,000,000 |

As you can see, the value of 100 Bitcoins can be quite substantial. It all depends on the market price at any given time.

Measuring Bitcoin's Value

Bitcoin's value can change quickly. Many factors influence its price. Understanding these factors helps measure its worth. Let's explore the key elements affecting Bitcoin's value.

Market Dynamics

The value of 100 Bitcoins depends on market dynamics. Supply and demand play a big role. When more people want Bitcoin, its price goes up. When fewer people want it, the price drops.

Trading volume is another factor. High trading volumes often lead to price increases. Low trading volumes can cause prices to fall.

The market sentiment also affects Bitcoin's value. Positive news can boost prices. Negative news can lead to price drops.

Factors Influencing Price

Several factors influence Bitcoin's price. Regulations can have a big impact. New laws can make prices rise or fall.

Technological advancements also play a role. Improvements in blockchain technology can increase Bitcoin's value. On the other hand, technological issues can decrease it.

Economic events affect Bitcoin too. Economic instability can drive people to buy Bitcoin. This increases its price. Conversely, economic stability can lead to price drops.

Here's a table summarizing these factors:

| Factor | Impact on Price |

|---|---|

| Supply and Demand | High demand increases price, low demand decreases it |

| Trading Volume | High volume increases price, low volume decreases it |

| Market Sentiment | Positive news increases price, negative news decreases it |

| Regulations | New laws can increase or decrease price |

| Technological Advancements | Improvements increase price, issues decrease it |

| Economic Events | Instability increases price, stability decreases it |

Understanding these factors helps in measuring Bitcoin's value. Keeping an eye on these can provide insights into Bitcoin's price movements.

Calculating The Worth Of 100 Bitcoins

Understanding the worth of 100 Bitcoins is crucial for investors. This section will explore how to calculate it using current and historical data.

Current Market Rates

To calculate the value of 100 Bitcoins, you need the current market rate. Bitcoin prices fluctuate daily, so use real-time data.

Here is a simple table to help you understand:

| Bitcoin (BTC) | Current USD Value |

|---|---|

| 1 BTC | $50,000 |

| 100 BTC | $5,000,000 |

So, if 1 Bitcoin equals $50,000, then 100 Bitcoins will be worth $5,000,000.

Historical Value Perspective

Looking at historical data helps understand Bitcoin's value changes. Bitcoin has seen dramatic price shifts over the years.

Here is a brief historical overview:

- 2010: Less than $1

- 2013: Around $1,000

- 2017: Surpassed $19,000

- 2021: Reached over $60,000

In 2010, 100 Bitcoins were worth less than $100. In 2021, their value exceeded $6,000,000.

Understanding these fluctuations is key. It helps investors make informed decisions.

By considering both current and historical data, you can better understand Bitcoin's worth.

Credit: news.bitcoin.com

The Impact Of Market Volatility

Market volatility greatly affects the value of Bitcoin. Understanding this helps in making informed decisions.

Bitcoin's price can change rapidly due to various factors. These include market demand, geopolitical events, and regulatory news.

Let's explore how market volatility impacts the worth of 100 Bitcoins.

Price Fluctuations

Bitcoin's price is known for its high volatility. One day it can rise sharply, and the next day it might fall.

For example, in January 2021, Bitcoin's price was around $30,000. By April 2021, it had surged to nearly $60,000.

This means the value of 100 Bitcoins could fluctuate between $3,000,000 and $6,000,000 in just a few months.

Several factors contribute to these price fluctuations:

- Market demand

- News and media coverage

- Regulatory changes

- Technological advancements

Predicting Future Value

Predicting the future value of Bitcoin is challenging. Analysts use different methods to estimate its price.

Some use technical analysis, looking at past price movements and trading volumes. Others rely on fundamental analysis, examining Bitcoin's intrinsic value and market position.

Here’s a comparison table of different prediction methods:

| Method | Description | Accuracy |

|---|---|---|

| Technical Analysis | Uses past data to predict future trends | Moderate |

| Fundamental Analysis | Assesses intrinsic value and market conditions | Varies |

| Sentiment Analysis | Evaluates public sentiment and news | Low |

Investors should be aware of these methods but also understand their limitations.

Market volatility makes Bitcoin an exciting but risky investment. Keep an eye on market trends and news.

Investor Sentiment And Bitcoin Valuation

Bitcoin's worth fluctuates based on various factors. One key element is investor sentiment. This section explores how public perception and institutional investment trends shape Bitcoin's value.

Public Perception

The public's view of Bitcoin significantly impacts its price. Positive news and endorsements often lead to price hikes. For example, a famous person tweeting about Bitcoin can cause a surge. On the other hand, negative news causes the price to drop.

Media plays a huge role too. News outlets and social media spread information quickly. This creates a feedback loop. The more people talk about Bitcoin, the more its price can change.

Here's a simple overview:

| Event | Impact on Bitcoin Price |

|---|---|

| Positive News | Price Increase |

| Negative News | Price Decrease |

| Famous Endorsement | Price Surge |

| Market Fears | Price Drop |

Institutional Investment Trends

Big companies and financial institutions have started investing in Bitcoin. Institutional investments bring credibility to Bitcoin. This often leads to a price increase.

Here are some key points:

- Increased Investments: When big firms invest, the price often rises.

- Regulatory Approval: Legal acceptance boosts investor confidence.

- Market Analysis: Institutions often base their investments on detailed research. Their actions signal market trends.

Institutional investments can be seen as a seal of approval. They indicate that Bitcoin is becoming mainstream. This trend is likely to continue, affecting Bitcoin's valuation.

Real-world Transactions With Bitcoin

Bitcoin is more than a digital asset. It is used in many real-world transactions. People use Bitcoin to buy products, pay for services, and even make large investments. This section explores how Bitcoin is accepted and spent in everyday life.

Acceptance And Spending

Many stores now accept Bitcoin. You can buy electronics, clothes, and even food using Bitcoin. Some online retailers also accept Bitcoin payments. This makes it easy to shop from the comfort of your home.

Here are some places where you can spend Bitcoin:

- Online retailers like Overstock and Newegg

- Restaurants and cafes

- Travel services like Expedia

- Charities and non-profits

More businesses are starting to accept Bitcoin every day. This makes it easier for people to use their Bitcoin in real-world transactions.

Large Scale Transactions

Bitcoin is not just for small purchases. People also use it for large-scale transactions. Some companies buy and sell real estate using Bitcoin. Others invest in Bitcoin for its potential growth.

Here are some examples of large transactions made with Bitcoin:

| Transaction Type | Details |

|---|---|

| Real Estate | Buying a luxury home |

| Investment | Purchasing large amounts of Bitcoin |

| Business Deals | Paying for services with Bitcoin |

These transactions show the versatility of Bitcoin. It is used for both small and large purchases. This makes it a valuable asset for many people.

Tax Implications And Regulatory Environment

The value of 100 Bitcoins can fluctuate widely. This makes it essential to understand the tax implications and regulatory environment. These factors can significantly impact your investment. Let's delve into the specifics of how taxation and regulations can affect your Bitcoin holdings.

Understanding Taxation

Taxation of Bitcoin varies by country. The Internal Revenue Service (IRS) in the United States classifies Bitcoin as property. This means you must report any gains or losses.

Here is a simple table to illustrate different tax scenarios:

| Scenario | Tax Implication |

|---|---|

| Buying and Holding | No immediate tax |

| Selling at a Profit | Capital gains tax |

| Selling at a Loss | Capital loss deduction |

Short-term gains are taxed higher than long-term gains. It’s vital to keep detailed records of your transactions.

Global Regulatory Landscape

Bitcoin regulations differ worldwide. Understanding these regulations can help you make informed decisions.

- United States: Bitcoin is legal, but regulations vary by state.

- European Union: Bitcoin is legal, and the European Court of Justice ruled it exempt from VAT.

- China: Bitcoin trading is banned, but owning it is not illegal.

- Japan: Recognized as legal property with specific regulations.

Regulations can change quickly. Always stay informed about the latest updates in your country.

The Future Of Bitcoin And Cryptocurrency

The future of Bitcoin and cryptocurrency intrigues many. It's a topic of much debate and speculation. Many want to know how much 100 Bitcoins will be worth in the future. Below, we explore technological advancements and predictions related to Bitcoin's future.

Technological Advancements

Technological advancements play a crucial role in Bitcoin's future. Innovations in blockchain technology can impact Bitcoin's value. Scalability solutions like the Lightning Network aim to make transactions faster and cheaper. These improvements can attract more users and increase demand.

Security enhancements are also vital. With better security, Bitcoin can gain trust. Quantum computing poses a threat, but quantum-resistant algorithms are in development. Integration with traditional finance systems can further boost Bitcoin's adoption. More ATMs and easier ways to buy Bitcoin can make it more accessible.

Predictions And Speculations

Experts have varying predictions about Bitcoin's future. Some believe Bitcoin will reach new all-time highs. Others think it could face significant challenges. John McAfee once predicted Bitcoin would reach $1 million. Peter Schiff, a known skeptic, believes Bitcoin's value will drop.

Institutional adoption is a key factor. Companies like Tesla and MicroStrategy have already invested in Bitcoin. Regulations can also impact Bitcoin's price. Stricter regulations might slow growth, while favorable regulations can boost it. Market sentiment and global economic conditions also play a role.

Here's a table summarizing some expert predictions:

| Expert | Prediction |

|---|---|

| John McAfee | $1 Million |

| Peter Schiff | Significant Drop |

| Bitcoin Bulls | New All-Time Highs |

Public sentiment and media coverage can also influence Bitcoin's value. Positive news can drive prices up. Negative news can have the opposite effect. Adoption by developing countries can also boost demand. Countries like El Salvador are already using Bitcoin as legal tender.

In summary, the future of Bitcoin and cryptocurrency is uncertain but promising. Technological advancements and market factors will shape its path. Staying informed is crucial for anyone interested in Bitcoin.

Credit: www.cnbc.com

Frequently Asked Questions

How Much Is $100 Bitcoin In Usd?

The value of $100 in Bitcoin changes frequently. Check a reliable cryptocurrency exchange for the current rate.

How Much Is $100 Dollars In Bitcoin?

The value of $100 in Bitcoin varies with the market. Check current rates on a reliable cryptocurrency exchange.

What Would $100 In Bitcoin Be Worth Today?

To determine the current value of $100 in Bitcoin, check the latest Bitcoin price on a cryptocurrency exchange. Bitcoin prices fluctuate frequently.

How Many $100 Is Bitcoin?

To find out how many $100 is in Bitcoin, divide $100 by the current Bitcoin price. Use a reliable exchange rate.

How Much Is 100 Bitcoins Worth Today?

The value of 100 Bitcoins fluctuates daily. Check the current exchange rate on a reliable cryptocurrency platform.

Conclusion

Understanding the value of 100 Bitcoins can help you stay informed and make better financial decisions. Bitcoin's price is volatile, so always monitor market trends. Investing wisely requires knowledge and caution. Stay updated with reliable sources to maximize your cryptocurrency investments.

Always consider seeking professional advice before making significant financial moves.